Private Wealth Management

Preserve, Grow, and Transmit Your Wealth Wisely

Build Your Legacy, Wealth & Beyond

We believe that successful investing isn’t about chasing occasional supernormal returns. Instead, it’s about generating consistent, handsome returns across all market cycles and over long periods, ensuring stability and growth.

Our approach transcends traditional wealth management. We focus on helping you build a sustainable legacy through a disciplined, systematic, and ever-evolving investment process, thoughtfully tailored to your unique needs and financial aspirations.

Using our proprietary due diligence framework, we rigorously evaluate the entire universe of asset classes, ensuring every recommendation aligns with your goals. Whether you’re aiming for wealth preservation, long-term growth, or creating meaningful impact, our expertise equips you to confidently navigate the complexities of today’s markets and secure a prosperous future.

Accredited By

Handpicked Solutions Unique to You

Equity

- Direct Equity Advisory

- Mutual Funds

- Portfolio Management Services (PMS)

- Alternate Investment Funds (AIFs)

- Broking*

Fixed Income

- Direct Bond Advisory

- Mutual Funds

- Portfolio Management Services (PMS)

- Alternate Investment Funds (AIFs)

- Bonds

Alternates

- Private Equity & Venture Capital Funds

- High Yield Private Debt

- Pre-IPO

- Real Estate & Multi-Strategy Funds

- Structured Products

- REITs, Invits, & Commodity ETFs

- Collectibles

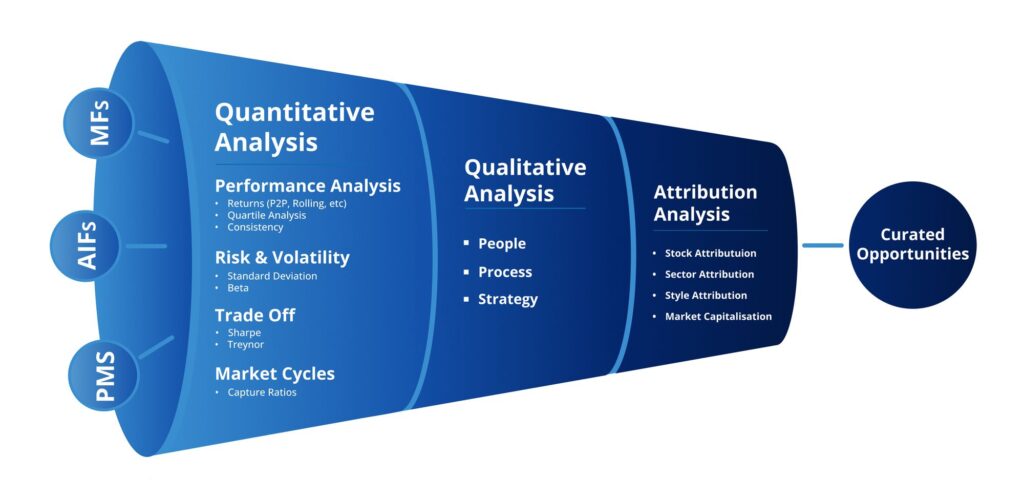

Our Proprietary Fund Evaluation Framework

We employ a proprietary fund evaluation framework that rigorously analyzes millions of data points across various market cycles. Our approach considers 4,000 parameters across 18 unique attributes for each fund in the investment universe, encompassing different asset classes and economic conditions. Our 'data-driven, human-led' methodology, enables a deep dive beyond surface-level insights to deliver precise, actionable strategies that align with your investment goals, risk tolerance and growth potential of funds across cycles.

Trusted by Industry Leaders

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

User - 2

Serial Entrepreneur

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

user - 1

Serial Entrepreneur

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

User - 2

Serial Entrepreneur

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

user - 1

Serial Entrepreneur

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

user - 1

Serial Entrepreneur

Meet our Team of Wealth Experts

Anuj Kapoor

Founder & Partner

Hyderabad | Mumbai

Abhijit Banerjee

Co-Founder & Partner

Hyderabad

Anuj Kapoor

Founder & Partner

Hyderabad | Mumbai

Anuj Kapoor

Founder & Partner

Hyderabad | Mumbai