M&A TAX & REGULATORY

Navigate Complex Transactions with Confidence

Simplifying M&A Complexities for Seamless Transactions

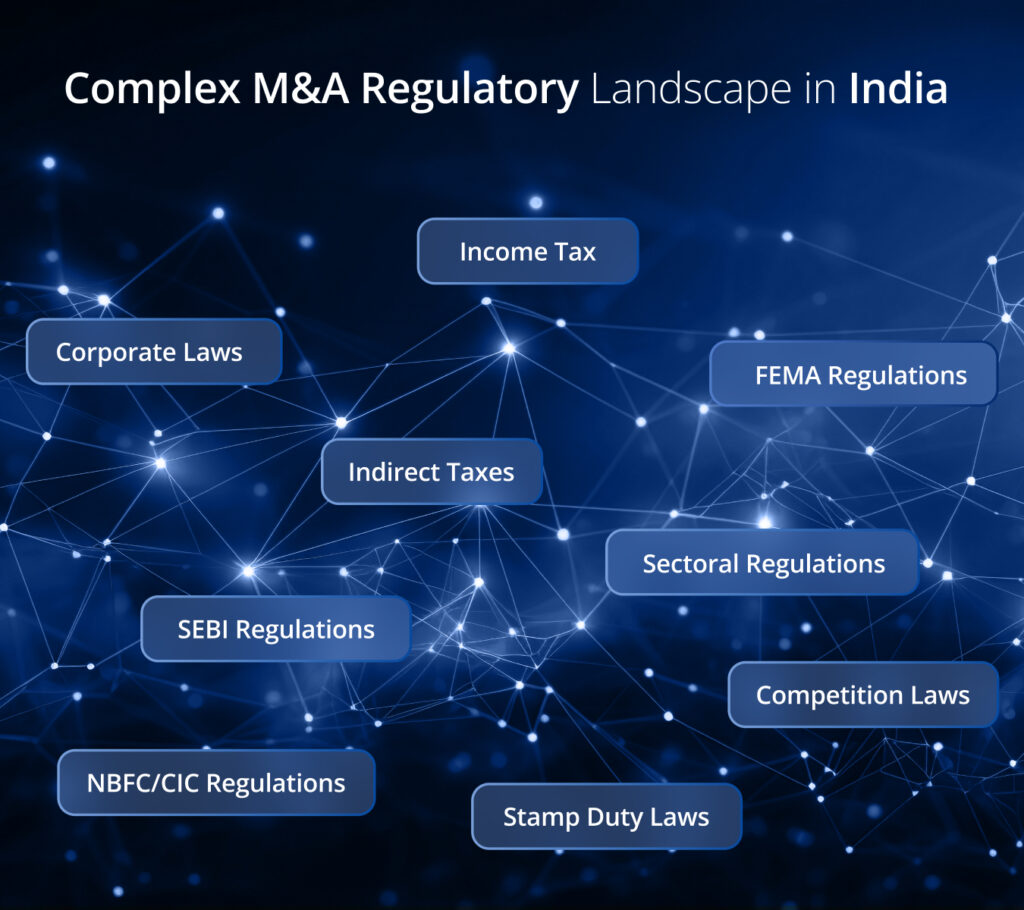

Major business transactions such as mergers, acquisitions, divestitures, and internal restructuring hold immense potential for growth and transformation. However, they also bring a host of intricate tax, legal, and regulatory challenges, which get further compounded by India’s dynamic, multi-layered regulatory landscape. Successfully navigating these complexities requires specialized expertise and strategic foresight.

Major business transactions such as mergers, acquisitions, divestitures, and internal restructuring hold immense potential for growth and transformation. However, they also bring a host of intricate tax, legal, and regulatory challenges, which get further compounded by India’s dynamic, multi-layered regulatory landscape. Successfully navigating these complexities requires specialized expertise and strategic foresight.

Recognizing that no two transactions are the same, we provide consciously tailored solutions designed to minimize tax burdens, meet compliance requirements, and optimize the overall value of your deals. Our collaborative approach ensures that your strategic objectives remain the focal point of every recommendation, allowing you to unlock value while mitigating risks.

Holistic Tax & Regulatory Services

- Sell-side Deal Advisory

- Buy-side Deal Advisory

- Joint Ventures

- Divestitures

- Strategic Alliances

- Growth Capital

- Platform Strategy

- Special Situations Financing:

- Acquisition Financing

- Leveraged Buyouts

- Equity Bridge Financing

- Growth Capital

- Platform Strategy

- Special Situations Financing:

- Acquisition Financing

- Leveraged Buyouts

- Equity Bridge Financing

- Growth Capital

- Platform Strategy

- Special Situations Financing:

- Acquisition Financing

- Leveraged Buyouts

- Equity Bridge Financing

- Growth Capital

- Platform Strategy

- Special Situations Financing:

- Acquisition Financing

- Leveraged Buyouts

- Equity Bridge Financing

Navigating Challenges, Delivering Results

Trusted by Industry Leaders

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

User - 2

Serial Entrepreneur

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

user - 1

Serial Entrepreneur

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

User - 2

Serial Entrepreneur

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

user - 1

Serial Entrepreneur

As a 6000-crore market cap company, we are very careful with whom we would want to work and Upwisery is the number one company when it comes to any acquisition targets that Zaggle thinks about. Whether it is mergers, acquisitions, or any commercial deals, for us it's always Upwisery. The team at Upwisery has always been extremely confidential, ethical, and has maintained highest level of integrity. Their ability to articulate the thought process of the founder to the investee company is brilliant.

-

user - 1

Serial Entrepreneur

Our Investment Banking Team

Anuj Kapoor

Founder & Partner

Hyderabad | Mumbai

Abhijit Banerjee

Co-Founder & Partner

Hyderabad

Anuj Kapoor

Founder & Partner

Hyderabad | Mumbai

Anuj Kapoor

Founder & Partner

Hyderabad | Mumbai